Yes, doing business in the Bronx isn’t easy. There are many problems and obstacles; the consequences of the big pandemic are still felt, and communication between entrepreneurs and banks is complicated. But thanks to organizations like the BXEDC, local entrepreneurs have hope for a bright future. We’ll tell you about the activities and focus of this organization in this article at bronx1.one.

BXEDC’s Mission and Goals

The Bronx Economic Development Corporation (BXEDC) was founded in March 1981. Its main initial goal was to develop a successful business community in the Bronx. The corporation supports local businesses by giving them access to financing and opportunities for growth, supporting existing businesses, and encouraging new ones to open.

The BXEDC works closely with the office of Bronx Borough President Vanessa Gibson on economic development issues. Gibson noted that similar funding programs haven’t been used since the Bill Clinton administration. In her opinion, this will allow the BXEDC, in partnership with The Business Initiative Corporation of New York (BICNY), to lend to small businesses that need working capital. Such projects not only support local enterprises but also create new jobs, contributing to economic growth.

Among the main initiatives of the BXEDC are:

- providing commercial loans for businesses in the South Bronx Empowerment Zone;

- technical assistance to improve commercial corridors;

- attracting public funds for business development;

- creating a network of partnerships to support businesses;

- collaborating with educational institutions;

- attracting corporate tenants to the Bronx.

The BXEDC’s main achievement was gaining approval to participate in the SBA Community Advantage Loan Program, which allowed it to provide working capital loans to enterprises and small businesses.

The BXEDC also initiated the Green Action Challenge program to improve environmental safety in the district’s educational institutions and launched the Commercial Corridor Improvement Initiative. The organization is establishing partnerships with large companies to promote local businesses and attracting new employees and board members from various sectors.

The Main Focus: Small Businesses

There are over 18,000 small businesses in the Bronx, which are the foundation of the local economy. However, they face various structural difficulties on the path to success. Approximately 70% of small businesses in the Bronx have problems getting funding, and more than half of them cannot implement their projects due to a lack of reliable banking relationships.

The Bronx is considered a low-to-moderate-income district. While the region is seeing an increase in new businesses, there is a trend of businesses closing within their first few years.

The BXEDC is working to meet the demand for capital in the Bronx to stimulate business activity and revitalize commercial corridors. The BXEDC’s lending arm—The Business Initiative Corporation of New York (BICNY)—collaborates with the U.S. Small Business Administration (SBA) program, which aims to create and preserve jobs.

During the COVID-19 pandemic, the Bronx Business Continuity Loan (BBCL) program was implemented. At that time, small businesses, which were already weak, found themselves in a critical situation. Thanks to the BXEDC’s support during the difficult quarantine period, many small businesses were saved. The consequences of the hit the COVID-19 epidemic had on the global economy are still being felt today. It is especially important to support regions with weak business positions, which includes the Bronx.

Over the last few months, the BXEDC has issued loans totaling $1.2 million to various small businesses. There are different conditions for receiving funds under this program. For example, a microloan can be up to $50,000 for a term of up to five years at 5% annual interest for businesses with 25 or fewer employees. Larger loans can be obtained by businesses for commercial development. These are amounts from $50,001 to $500,000 for a term of up to ten years. In this case, loan payments will consist of the basic WSJ rate plus 1–2%.

Examples of Targeted Assistance from the BXEDC

Many small businesses in the Bronx have been saved thanks to the coordinated work of the BXEDC, the government, and banks. Most often, requests to participate in the program come from immigrant business owners. Opening and maintaining a business in a foreign country is incredibly difficult.

“Tobala” is one of many small businesses that benefited from these low-interest lending programs. “Tobala” is an Oaxacan restaurant on Riverdale Avenue. It is very popular with residents and visitors, and the restaurant has high ratings on all relevant platforms. On weekends, it’s difficult to find an empty table; the convenient location and delicious authentic cuisine add to the establishment’s appeal. But at one point, the restaurant’s management had to turn to the BXEDC for help. The problem was the high-interest rates the restaurant was paying on its original loans. The BXEDC staff helped the owners refinance some of the high-interest loans into lower-interest loans, which allowed them to save the business from bankruptcy.

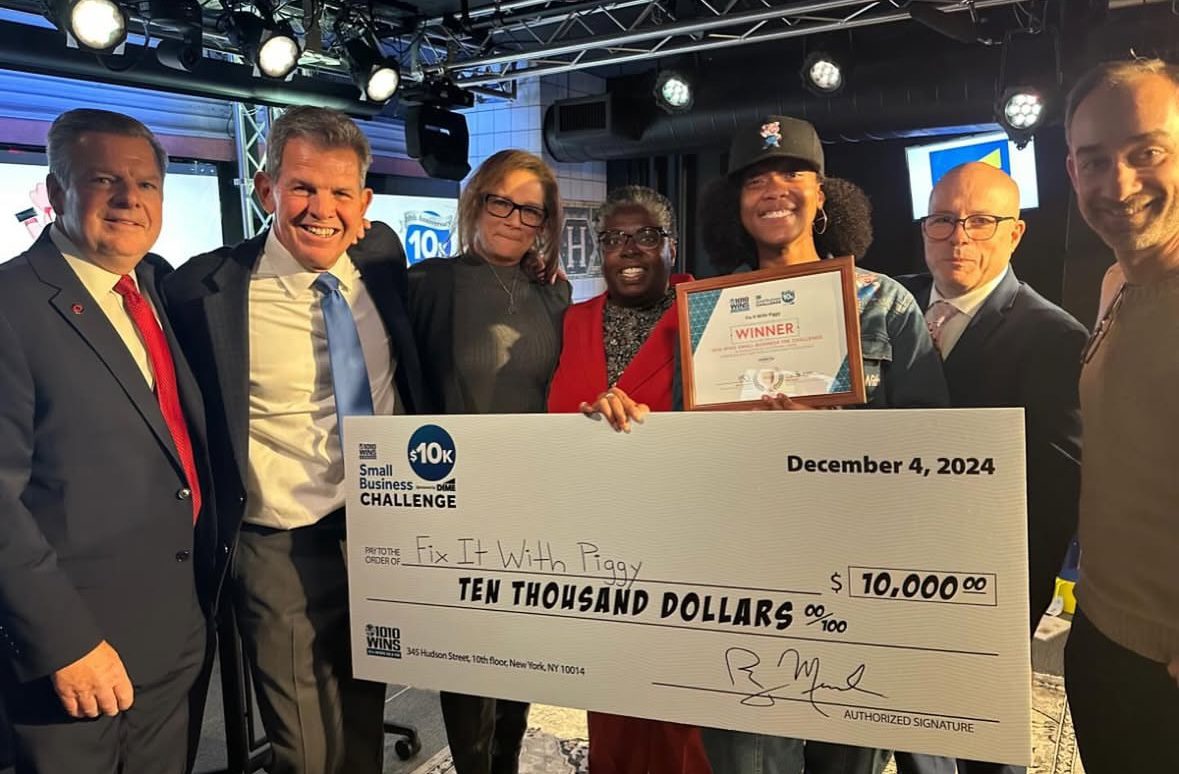

Another wonderful establishment with a positive, bright name is “Cupcake Me!”. Its owner, Brittany Moss, started a business baking custom cakes and cupcakes at home. Her products were in high demand, but Brittany didn’t know where to get the money to scale up. After contacting the BXEDC, she received a loan and was able to hire employees and expand production.

You can read the life story of a successful entrepreneur from the Bronx in this article.

Collaboration with Educational Institutions and Consulting Assistance

The BXEDC also collaborates with colleges and universities in the Bronx. Recently, after a rigorous selection process, the BXEDC allocated $1 million to Bronx Community College for programs that promote environmentally friendly technologies on campus. This was made possible by a grant from the New York State Energy Research and Development Authority as part of the Green Action Challenge initiative. Access to funding through loans and grants is just one of the areas of the BXEDC’s work in economic development. The organization also provides business education for small business owners in the Bronx. BXEDC staff actively work with clients, helping them create business plans, financial plans, and prepare for obtaining loans.

At the BXEDC, they understand that small businesses in the Bronx often lack the technical support and financial advice needed to obtain loans and achieve sustainable success. For many entrepreneurs, important resources such as help with loan applications, lending advice, and financial planning remain inaccessible. To solve this problem, the BXEDC holds specialized seminars in collaboration with local banks. This initiative became the foundation for another major goal of the BXEDC—to create a unique co-working and business support center that will provide personalized financial education, practical technical assistance, and direct access to capital.

The Bronx remains the borough of New York with the largest number of banks, yet 17% of its residents have no relationship with financial institutions. Despite many problems, such as branch closures or high overdraft fees, banks need to work on rebuilding trust. Therefore, the BXEDC aims to attract Bronx banks to finance the project of creating a single co-working center, which will become a place for collaboration between banking institutions, Bronx entrepreneurs, and support structures like the BXEDC.

You can read about another organization in the Bronx that directs its activities toward supporting vulnerable populations in this article.